Differences between Fixed cost and Variable cost

Fixed cost and variable cost[edit]

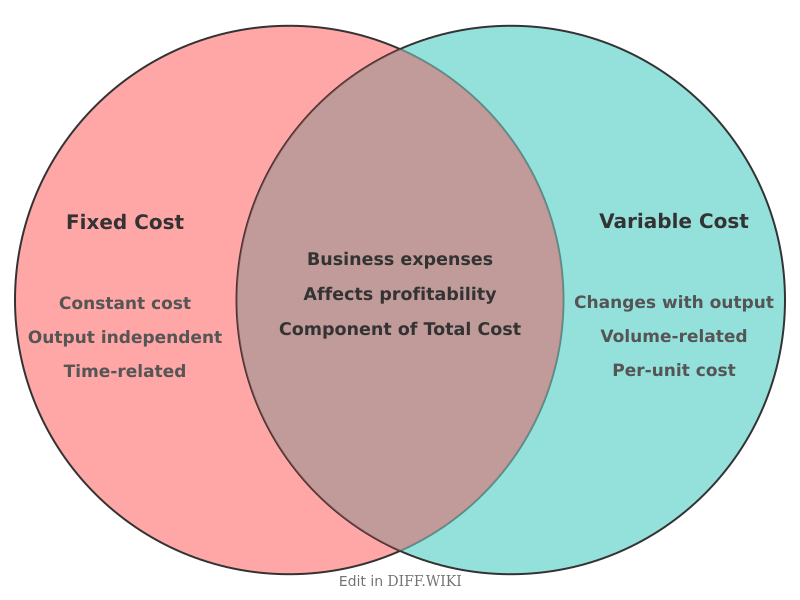

In accounting and economics, the two major components of a business's total cost are fixed costs and variable costs.[1] Fixed costs are expenses that do not change in relation to the volume of goods or services a company produces over a specific period. In contrast, variable costs are expenses that fluctuate in direct proportion to production output.[2] Understanding the distinction between these cost types is a component of cost-volume-profit analysis and can inform a company's pricing, production, and profitability decisions.[3] The sum of a company's total fixed costs and total variable costs is equal to its total cost.[4]

Comparison table[edit]

| Category | Fixed cost | Variable cost |

|---|---|---|

| Definition | An expense that remains constant regardless of production volume.[5] | An expense that changes in proportion to production volume. |

| Relation to production | Independent of output. A company incurs these costs even with zero production. | Directly dependent on output. These costs are zero if production is zero. |

| Cost per unit | Decreases as production increases because the total fixed cost is spread over more units. | Remains constant for each unit produced. |

| Examples | Rent, insurance, property taxes, salaries of administrative staff, and depreciation of equipment. | Raw materials, direct labor, sales commissions, packaging, and utilities tied to production. |

| Time horizon | Costs are considered fixed only in the short run. | In the long run, all costs are considered variable as contracts can be renegotiated and assets can be sold or acquired.[1] |

| Business risk | Presents higher risk during periods of low sales, as the cost must be paid regardless of revenue. | Presents lower risk, as the cost decreases when production and sales fall. |

Semi-variable costs[edit]

Some expenses, known as semi-variable or mixed costs, contain both fixed and variable components. These costs include a baseline fixed expense that is incurred regardless of activity, and a variable component that changes with the level of production. A common example is a utility bill, which may include a fixed monthly service charge plus a variable charge based on the amount of electricity consumed during production activities. Another example is the salary of a salesperson who earns a fixed base salary plus a variable commission based on sales volume.

References[edit]

- ↑ 1.0 1.1 "wikipedia.org". Retrieved January 29, 2026.

- ↑ "wikipedia.org". Retrieved January 29, 2026.

- ↑ "wikipedia.org". Retrieved January 29, 2026.

- ↑ "blockadvisors.com". Retrieved January 29, 2026.

- ↑ "corporatefinanceinstitute.com". Retrieved January 29, 2026.