Differences between Forward Contract and Futures Contract

Contents

Forward Contract vs. Futures Contract[edit]

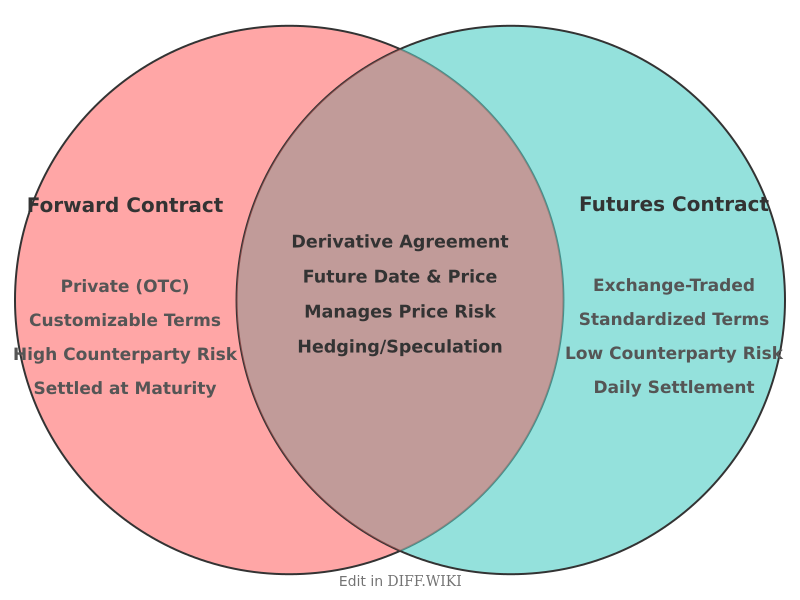

A forward contract is a customized agreement between two parties to buy or sell an asset at a specified price on a future date.[1][2][3] A futures contract is a standardized legal agreement to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future.[1][4] Both are types of derivative contracts used by businesses and investors for hedging and speculation.[5] The primary distinction lies in their customization and trading venue; forward contracts are private, over-the-counter (OTC) agreements, while futures are traded on public exchanges.[1]

Comparison Table[edit]

| Category | Forward Contract | Futures Contract |

|---|---|---|

| Trading Venue | Over-the-counter (OTC); privately negotiated between two parties.[1] | Traded on a centralized and regulated exchange.[1][4] |

| Standardization | Highly customizable; terms like contract size, quality, and delivery date are negotiated by the parties.[3] | Highly standardized; contract terms are set by the exchange.[1][3] |

| Regulation | Largely unregulated as they are private agreements.[2] | Regulated by government agencies, such as the Commodity Futures Trading Commission (CFTC) in the U.S.[1] |

| Counterparty Risk | High, as the performance of the contract depends on the counterparty's ability to fulfill their obligation.[1] | Low, as a clearing house associated with the exchange acts as the counterparty to both buyer and seller, guaranteeing the trade.[2] |

| Settlement | Settled once at the maturity of the contract.[1] | Marked-to-market daily, where profits and losses are settled each day until the contract's end.[2][3][4] |

| Liquidity | Generally low, as the customized nature makes them difficult to exit before maturity. | High, due to standardization and trading on an exchange, allowing easy entry and exit of positions.[1] |

| Margin Requirement | Typically no initial margin is required.[2] | An initial margin is required to be deposited by both parties as collateral.[2][3] |

Key Differences Explained[edit]

Regulation and Counterparty Risk[edit]

Futures contracts are traded on organized exchanges and are subject to oversight by regulatory bodies like the Commodity Futures Trading Commission (CFTC) in the United States.[1] This regulatory structure involves a clearing house that acts as an intermediary, becoming the buyer to every seller and the seller to every buyer. This process significantly reduces counterparty risk, which is the risk that one of the parties will default on its obligation.[2]

In contrast, forward contracts are private agreements traded over-the-counter and are mostly unregulated.[2] The fulfillment of a forward contract relies entirely on the creditworthiness of the two parties involved, resulting in a higher degree of counterparty risk.[1]

Standardization and Liquidity[edit]

The terms of a futures contract, including the asset's quantity and quality, delivery date, and location, are standardized by the exchange.[3] This uniformity allows for a high level of liquidity, as numerous market participants can trade the identical contracts.

Forward contracts are customizable, with terms tailored to the specific needs of the buyer and seller.[3] While this flexibility is a primary advantage for hedgers with specific needs, it also makes the contracts illiquid. Exiting a forward contract before its maturity date can be difficult as it requires finding another party willing to take on the exact same custom terms.

Settlement Process[edit]

A significant operational difference is the settlement of gains and losses. Futures contracts are "marked-to-market" on a daily basis.[1][3] This means that at the end of each trading day, the contract's value is adjusted to reflect the current market price, and the resulting profit or loss is credited to or debited from the parties' margin accounts.[2]

Forward contracts, however, are typically settled only on the expiration date.[1] The entire profit or loss, which is the difference between the agreed-upon price and the market price at maturity, is realized at the end of the contract's life.[4] While most forward contracts result in the physical delivery of the asset, a majority of futures contracts are closed out before the expiration date.

References[edit]

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 1.13 "investopedia.com". Retrieved December 25, 2025.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 "futurelearn.com". Retrieved December 25, 2025.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3.7 "religareonline.com". Retrieved December 25, 2025.

- ↑ 4.0 4.1 4.2 4.3 "angelone.in". Retrieved December 25, 2025.

- ↑ "corporatefinanceinstitute.com". Retrieved December 25, 2025.