Differences between HRA and HSA

Contents

Health Reimbursement Arrangement vs. Health Savings Account[edit]

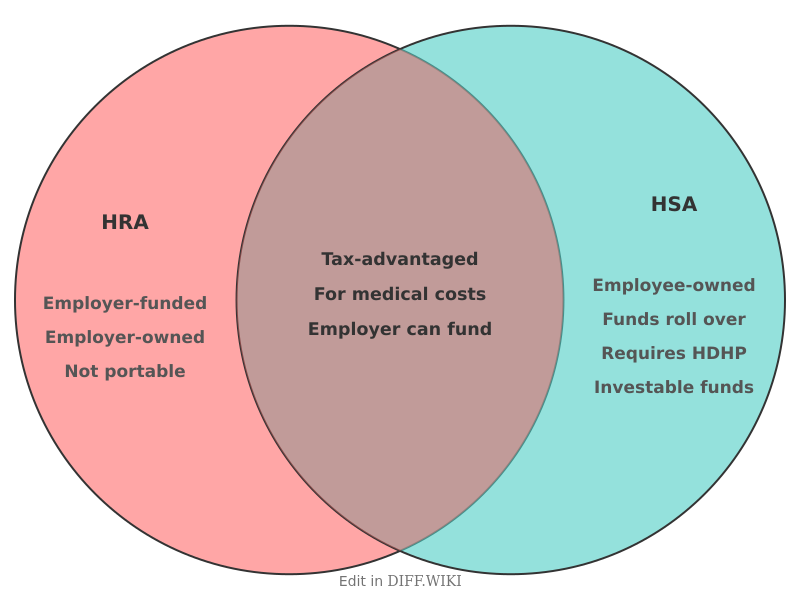

A Health Reimbursement Arrangement (HRA) and a Health Savings Account (HSA) are both tax-advantaged accounts used for qualified medical expenses in the United States.[1] While they share the goal of helping individuals pay for healthcare, they have distinct differences in terms of eligibility, contributions, ownership, and portability.[1][2] An HRA is an employer-funded and owned account, whereas an HSA is owned by the individual.[3][4]

Comparison Table[edit]

| Category | Health Reimbursement Arrangement (HRA) | Health Savings Account (HSA) |

|---|---|---|

| Eligibility | Employers determine employee eligibility; not required to be paired with a specific type of health plan.[3][5] | Must be enrolled in a high-deductible health plan (HDHP).[3] Cannot be claimed as a dependent on someone else's tax return or be enrolled in Medicare.[1] |

| Account Ownership | Owned by the employer.[1][5] | Owned by the individual employee.[3][1] |

| Contribution Source | Funded solely by the employer; employees cannot contribute. | Can be funded by the employee, the employer, or both. |

| Contribution Limits | Varies by HRA type. Some, like the Qualified Small Employer HRA (QSEHRA), have annual limits set by the IRS, while others do not have federal limits.[1] | The IRS sets annual contribution limits. |

| Portability | Generally not portable; funds are typically forfeited if the employee leaves the company.[1] | Fully portable; the account and its funds remain with the employee regardless of employment status.[4] |

| Rollover of Funds | Employer determines if unused funds can roll over to the next year; some plans have a "use-it-or-lose-it" policy.[3] | Unused funds automatically roll over year after year.[1] |

| Investment Options | Funds cannot be invested. | Funds can be invested in stocks, bonds, and mutual funds, allowing for potential growth.[5] |

Key Distinctions[edit]

The primary difference lies in the ownership and funding of the accounts. HRAs are established and funded exclusively by employers, who also dictate the terms of the arrangement, including which medical expenses are eligible for reimbursement.[1] This gives employers control over the funds.[5] Conversely, HSAs are individual accounts that can be funded by both the employee and employer. The employee owns the HSA and has control over how the funds are used for qualified medical expenses and whether they are invested.[3][4]

Another significant difference is the requirement of a specific health insurance plan. To contribute to an HSA, an individual must be enrolled in a high-deductible health plan (HDHP). There is no such requirement for an HRA, which can be offered with any type of health plan.[2]

The portability of the funds also sets the two accounts apart. When an employee with an HRA leaves their job, they typically lose access to any remaining funds in the account.[1] An HSA, however, is portable and remains with the individual even after they change employers, retire, or become unemployed. This allows the funds in an HSA to accumulate over the long term.

Finally, the treatment of unused funds differs. While all unused funds in an HSA automatically roll over to the next year, the rollover of HRA funds is at the discretion of the employer.[3] Some HRA plans may require employees to forfeit any unused amount at the end of the plan year. Additionally, HSAs offer the ability to invest the funds, which is not an option for HRAs.[5]

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 "metlife.com". Retrieved January 28, 2026.

- ↑ 2.0 2.1 "fidelity.com". Retrieved January 28, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 "joinforma.com". Retrieved January 28, 2026.

- ↑ 4.0 4.1 4.2 "paycor.com". Retrieved January 28, 2026.

- ↑ 5.0 5.1 5.2 5.3 5.4 "onpay.com". Retrieved January 28, 2026.