Differences between IRA and Roth IRA

Traditional IRA vs. Roth IRA[edit]

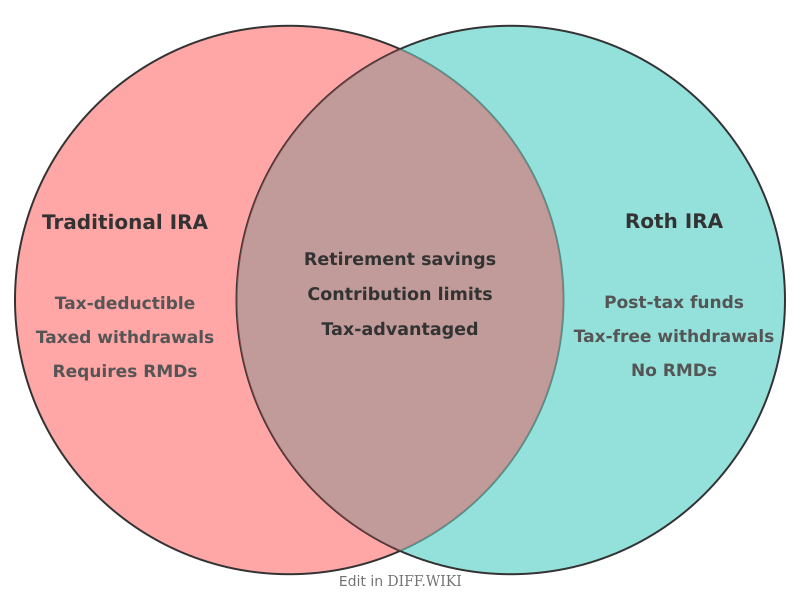

A Traditional Individual Retirement Arrangement (IRA) and a Roth IRA are retirement savings plans that offer different tax advantages.[1] The main distinction between them lies in the tax treatment of contributions and withdrawals.[2] Contributions to a Traditional IRA may be tax-deductible, and the investments grow tax-deferred until retirement, at which point withdrawals are taxed as ordinary income.[3] Conversely, Roth IRA contributions are made with after-tax dollars and are not tax-deductible, but qualified withdrawals in retirement are tax-free.[1][4]

Both types of IRAs have the same annual contribution limits, which for 2026 is $7,500, or $8,600 for individuals aged 50 and over.[5] However, the ability to contribute to a Roth IRA is subject to income limitations.[5] While anyone with earned income can contribute to a Traditional IRA, the tax-deductibility of those contributions may be limited based on income and whether the individual or their spouse is covered by a workplace retirement plan.[2]

Another key difference is the treatment of required minimum distributions (RMDs). Traditional IRAs require the account holder to begin taking distributions at age 73. Roth IRAs do not have RMDs for the original account owner.

Comparison Table[edit]

| Category | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Treatment of Contributions | Contributions may be tax-deductible[1] | Contributions are made with after-tax dollars and are not tax-deductible[1][3] |

| Tax Treatment of Withdrawals | Withdrawals are taxed as ordinary income in retirement[4] | Qualified withdrawals are tax-free in retirement[4] |

| Income Limitations for Contributions | No income limits to contribute[5] | Contributions are limited based on modified adjusted gross income (MAGI)[5] |

| Deductibility of Contributions | Contributions may be fully or partially deductible, depending on income and workplace retirement plan coverage[2] | Contributions are not tax-deductible |

| Required Minimum Distributions (RMDs) | RMDs are required to begin at age 73 | No RMDs for the original account owner |

| Early Withdrawal of Contributions | Withdrawals of contributions before age 59½ are subject to taxes and a 10% penalty, with some exceptions | Contributions can be withdrawn at any time, tax-free and penalty-free |

| Early Withdrawal of Earnings | Withdrawals of earnings before age 59½ are subject to taxes and a 10% penalty, with some exceptions | Withdrawals of earnings before age 59½ may be subject to taxes and a 10% penalty, with some exceptions |