Differences between Inc. and LLC

Contents

Corporation vs. LLC[edit]

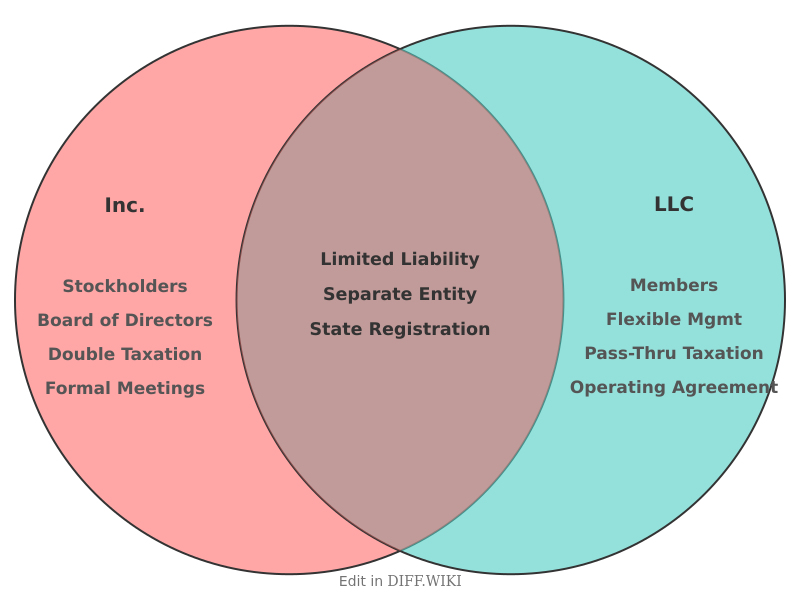

A Corporation (Inc.) and a Limited Liability Company (LLC) are business structures created by state filing that separate the business entity from its owners.[1][2] Both structures provide owners with limited liability protection, shielding their personal assets from the company's debts and lawsuits.[3][2] However, they differ significantly in their internal structure, management, taxation, and administrative requirements.[3][4] The choice between an LLC and a corporation often depends on the business's goals regarding taxation, operational flexibility, and long-term growth plans.[5]

Comparison Table[edit]

| Category | Corporation (Inc.) | Limited Liability Company (LLC) |

|---|---|---|

| Ownership | Owned by shareholders who hold stock. Can have unlimited shareholders (C corp) or up to 100 (S corp). | Owned by members who have an ownership interest.[1] Can have an unlimited number of members. |

| Liability Protection | Provides a strong level of liability protection for its shareholders.[3][2] | Provides members with liability protection for business debts and legal actions.[3][2] |

| Taxation | Taxed as a separate entity (C corp), leading to potential double taxation of profits and dividends.[3] Can elect S corp status for pass-through taxation.[2] | Default is pass-through taxation, where profits/losses are reported on owners' personal tax returns. Can elect to be taxed as a corporation. |

| Management Structure | Rigid structure with a board of directors elected by shareholders to manage the business, and officers to run daily operations.[3] | Flexible management structure. Can be managed by its members or by appointed managers.[3][4] |

| Administrative Formalities | Requires strict compliance, including annual meetings, maintaining corporate minutes, and adopting bylaws.[3] | Fewer formal requirements; an operating agreement is recommended but not always mandatory. Record-keeping is generally less stringent than for corporations.[3] |

| Raising Capital | Can raise capital by selling stock to investors.[5] | Ownership transfer can be more complex, potentially limiting the ability to attract outside investors. |

Taxation[edit]

A primary distinction between LLCs and corporations lies in how they are taxed. By default, a standard corporation (or C corp) is a separate taxable entity and pays corporate income tax on its profits. If the corporation distributes after-tax profits to shareholders as dividends, those shareholders then pay personal income tax on that income, a situation often called "double taxation."

In contrast, an LLC is typically treated as a "pass-through" entity for tax purposes. This means the business's profits and losses are passed directly to its members, who report them on their personal tax returns. The LLC itself does not pay federal income taxes.

However, both structures offer some flexibility. An LLC can elect to be taxed as a corporation (either a C corp or an S corp).[2] Similarly, a corporation that meets certain IRS criteria, such as having no more than 100 shareholders, can file for S corp status. S corporations are pass-through entities, which allows them to avoid the double taxation associated with C corps.

Management and Operations[edit]

Corporations have a more formal and rigid management structure established by state law. This hierarchy includes shareholders, a board of directors, and officers.[3] Shareholders own the company, the board of directors oversees major decisions, and officers manage daily activities.[4] Corporate law requires adherence to strict formalities, such as holding regular board and shareholder meetings and keeping detailed records known as corporate minutes.[3]

LLCs offer greater operational flexibility.[3] An LLC can be managed directly by its members (member-managed) or by designated managers (manager-managed), who may or may not be members.[4] State laws generally impose fewer ongoing administrative requirements on LLCs compared to corporations.[3] While an operating agreement that outlines the management structure and operational rules is highly recommended for LLCs, it is not legally required in all states.

References[edit]

- ↑ 1.0 1.1 "quill.com". Retrieved December 27, 2025.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 "wolterskluwer.com". Retrieved December 27, 2025.

- ↑ 3.00 3.01 3.02 3.03 3.04 3.05 3.06 3.07 3.08 3.09 3.10 3.11 3.12 "legalzoom.com". Retrieved December 27, 2025.

- ↑ 4.0 4.1 4.2 4.3 "nchinc.com". Retrieved December 27, 2025.

- ↑ 5.0 5.1 "mycorporation.com". Retrieved December 27, 2025.