Differences between LLC and LLP

Contents

Limited Liability Company vs. Limited Liability Partnership[edit]

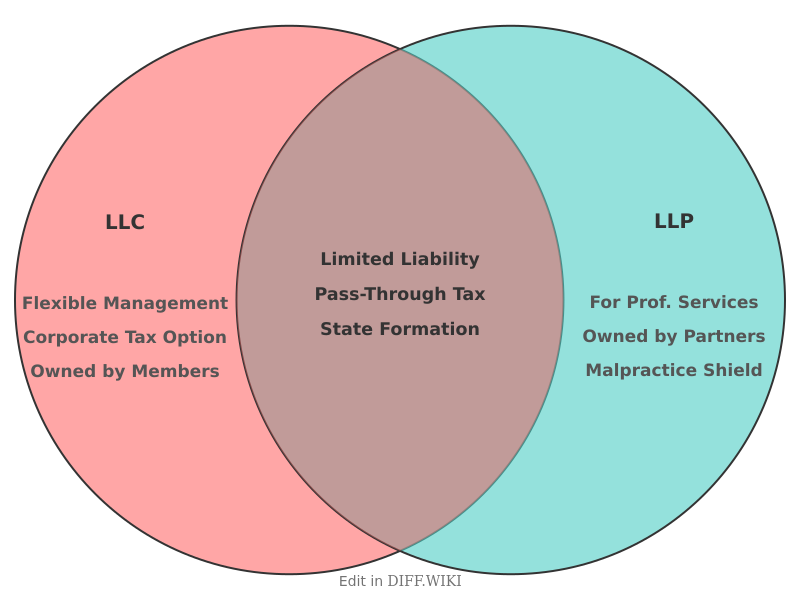

A Limited Liability Company (LLC) and a Limited Liability Partnership (LLP) are business structures that provide owners with a degree of protection from personal liability for the business's debts and actions.[1] While both entities combine aspects of corporations and partnerships, they possess distinct differences in their structure, liability limitations, and management.[2][3] The suitability of an LLC versus an LLP often depends on the industry, the number of owners, and the specific laws of the state in which the business is formed.[4]

Comparison Table[edit]

| Category | Limited Liability Company (LLC) | Limited Liability Partnership (LLP) |

|---|---|---|

| Liability Protection | Members are protected from personal liability for all business debts and lawsuits.[5] | Partners are shielded from the negligence or malpractice of other partners, but may remain liable for their own actions and overall business debts. |

| Ownership | Can be owned by one or more individuals or entities, known as "members."[2] | Requires a minimum of two owners, referred to as "partners."[2] |

| Eligible Business Types | Open to most types of businesses, with some exceptions like banking and insurance.[2][5] | Often restricted to specific licensed professions such as law, accounting, or architecture, depending on state law.[2] |

| Management Structure | Can be managed by its members (member-managed) or by appointed managers (manager-managed). | Typically managed directly by the partners, with management responsibilities outlined in a partnership agreement. |

| Taxation | By default, taxed as a pass-through entity (sole proprietorship for one member, partnership for multiple members). Can elect to be taxed as a C corporation or an S corporation. | Taxed as a pass-through entity, with profits and losses reported on the partners' personal tax returns.[1] |

Liability Protection[edit]

The extent of personal liability protection is a primary distinction between LLCs and LLPs. An LLC generally offers its members broad protection from the debts and legal liabilities of the business.[4] This means a member's personal assets are typically shielded from claims against the company.[5]

In contrast, an LLP's liability protection is more specific. It primarily protects partners from being personally responsible for the professional negligence or malpractice of their fellow partners. However, a partner remains personally liable for their own misconduct, and in some states, partners may still be personally responsible for the general debts and obligations of the partnership.[4]

Management and Ownership[edit]

LLCs offer significant flexibility in terms of ownership and management. An LLC can have a single owner (a single-member LLC) or multiple owners, who can be individuals or other business entities.[2] The management structure can be tailored to the business's needs; in a member-managed LLC, all owners participate in the daily operations, while in a manager-managed LLC, designated managers (who may or may not be members) are appointed to run the company.

LLPs, by definition, must have at least two partners. The management of an LLP is typically handled by the partners themselves, who share in the decision-making and operational responsibilities as detailed in their partnership agreement. This structure is common in professional firms where partners collaborate and manage the practice together.

Taxation[edit]

Both LLCs and LLPs are generally treated as "pass-through" entities for tax purposes. This means the business itself does not pay income tax; instead, the profits and losses are passed through to the owners and reported on their personal tax returns. LLC members and LLP partners are typically responsible for paying self-employment taxes.

A key tax difference is that an LLC has the flexibility to elect its tax status. While a multi-member LLC is taxed as a partnership by default, it can choose to be taxed as a C corporation or an S corporation if it meets the requirements. This option is not available to LLPs, which are taxed as partnerships.[1] The decision to elect a different tax status can have significant financial implications depending on the business's income and goals.

References[edit]

- ↑ 1.0 1.1 1.2 "andersonadvisors.com". Retrieved February 10, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 "legalzoom.com". Retrieved February 10, 2026.

- ↑ "howtostartanllc.com". Retrieved February 10, 2026.

- ↑ 4.0 4.1 4.2 "nolo.com". Retrieved February 10, 2026.

- ↑ 5.0 5.1 5.2 "legalshield.com". Retrieved February 10, 2026.