Differences between Ponzi Scheme and Social Security

Contents

Comparison Article[edit]

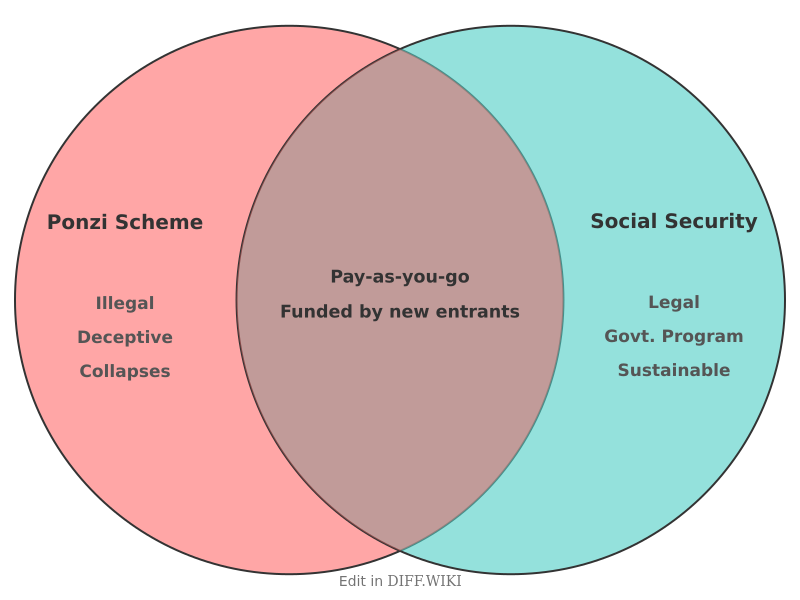

A Ponzi scheme is a fraudulent investment operation that pays returns to earlier investors with money from more recent investors, rather than from any legitimate investment profit.[1] The United States' Social Security program is a government-administered social insurance program that provides retirement, disability, and survivor benefits.[1] While both systems involve payments from newer participants being used to pay earlier ones, there are fundamental differences in their legality, purpose, and structure.[2][3]

Critics of Social Security sometimes compare it to a Ponzi scheme because it operates on a pay-as-you-go basis, where contributions from today's workers are used to pay the benefits of current retirees.[4] However, key legal and operational distinctions separate the two.[1]

Comparison Table[edit]

| Category | Ponzi Scheme | Social Security |

|---|---|---|

| Purpose | To enrich its organizers by deceiving investors. | To provide a social safety net for retirees, the disabled, and survivors as part of a public welfare policy.[3] |

| Legality | Illegal and fraudulent.[1] | A legal, government-mandated public program established by the Social Security Act of 1935.[1][3] |

| Transparency | Opaque. Organizers conceal the fact that payments come from new investments, often claiming fictitious profits.[3] | Operations are transparent. The Social Security Administration (SSA) publicly reports its financial state, funding mechanisms, and actuarial projections.[2][1] |

| Source of Funds | Money from new investors, who are deceived into believing they are funding a legitimate enterprise.[2] | Funded primarily by mandatory payroll taxes (FICA) on employees and employers.[5] Surpluses are held in trust funds that invest in U.S. Treasury securities. |

| Longevity | Designed to collapse when the recruitment of new investors slows down. The average lifespan is short.[2][3] | Designed to be perpetual. It can be modified by legislation to adapt to demographic and economic changes, such as adjusting the full retirement age or tax rates. |

| Stated Returns | Promises unusually high and consistent returns to attract investors.[2] | Benefit amounts are determined by a public formula based on a worker's earnings history and are not promised as a return on investment.[1] |

Funding and operation[edit]

A Ponzi scheme's survival depends on an exponentially growing base of new investors to pay off the previous ones.[2] This model is unsustainable and inevitably collapses when it can no longer attract sufficient funds.[1] Social Security, by contrast, is funded by dedicated payroll taxes collected from a continuous base of workers and employers. While it faces long-term financial challenges due to demographic shifts, such as lower birth rates and longer life expectancies, it is not designed to collapse.[2] The U.S. government can make adjustments to the program to ensure its solvency.

Intent and oversight[edit]

The core of a Ponzi scheme is deception.[3] Its operators fraudulently misrepresent the source of profits to lure investors. Social Security has no such fraudulent intent; it is a transparent government program with a public mission to provide social insurance.[3] The program's finances are a matter of public record, and its future is the subject of ongoing political and public debate. It is administered by the Social Security Administration, an independent agency of the U.S. federal government.[1]

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 "taxproject.org". Retrieved January 22, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 "urban.org". Retrieved January 22, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 "michiganstatelawreview.org". Retrieved January 22, 2026.

- ↑ "hoover.org". Retrieved January 22, 2026.

- ↑ "wikipedia.org". Retrieved January 22, 2026.