Differences between Acquisition and Merger

Contents

Acquisition vs. Merger

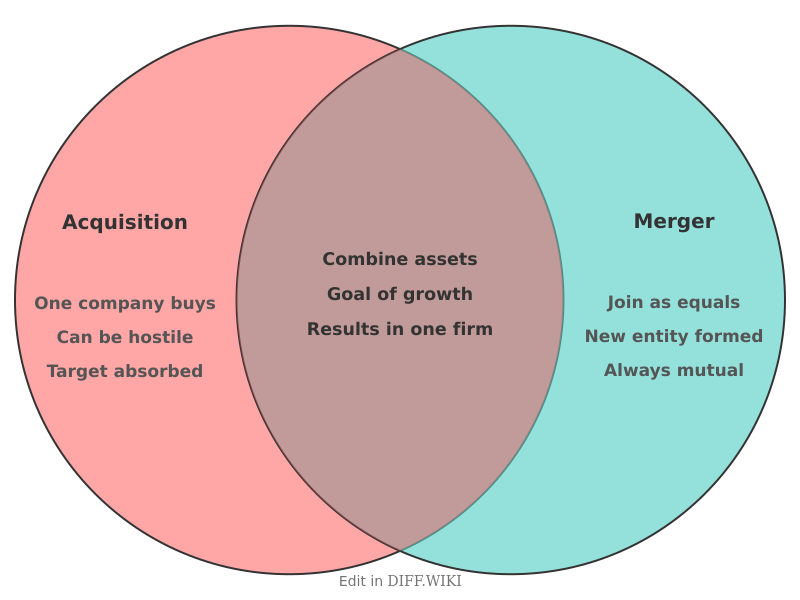

An acquisition is a transaction where one company purchases a majority or all of another company's shares to take control.[1][2] In contrast, a merger is the combination of two companies into a new legal entity. The terms are often used interchangeably, though they denote different financial and legal processes.[1][3]

Comparison Table

| Category | Acquisition | Merger |

|---|---|---|

| Resulting Entity | The acquiring company absorbs the target company, which may cease to exist as an independent entity or become a subsidiary.[4][5] | A new company is formed, and the original companies cease to exist. |

| Identity | The acquiring company's identity is maintained. | A new, combined identity is often created. |

| Size of Companies | The acquiring company is typically larger than the target company. | The companies are often of similar size and stature. |

| Control | The acquiring company gains control over the acquired company. | Control is shared between the leadership of the two original companies. |

| Nature of Transaction | Can be friendly or hostile, where the target company's management may not approve of the transaction.[5] | Generally a mutual and voluntary agreement between the two companies. |

Notable Examples

A well-known example of an acquisition is Google's purchase of Android in 2005. Google acquired the smaller mobile startup, and Android now operates as a subsidiary under its parent company. Another prominent acquisition was Microsoft's purchase of the professional networking site LinkedIn.

The 2015 transaction between Dow Chemical and DuPont is an example of a merger of equals, creating the new entity DowDuPont. Another significant merger was the 2006 union of Disney and Pixar, which combined the strengths of both animation studios.

Strategic Motivations

Companies pursue acquisitions and mergers for a variety of strategic reasons. A primary driver for both is to achieve synergies, where the combined entity is more valuable than the two independent companies.[4] This can be accomplished through economies of scale, increased market share, or the acquisition of new technology or talent.

Acquisitions are often a quicker way for a company to enter a new market or to eliminate a competitor. Mergers, being more collaborative, can be a way to pool resources and share risks in a new venture. Both transactions are complex and require significant due diligence to assess the financial health and potential risks of the companies involved.[4]

References

- ↑ 1.0 1.1 "investopedia.com". Retrieved January 31, 2026.

- ↑ "theforage.com". Retrieved January 31, 2026.

- ↑ "investopedia.com". Retrieved January 31, 2026.

- ↑ 4.0 4.1 4.2 "wikipedia.org". Retrieved January 31, 2026.

- ↑ 5.0 5.1 "greatlawyers.com". Retrieved January 31, 2026.